China and Brazil: Far Away, So Close

The 17,000 kilometers that separate Beijing from Brasilia are no obstacle for China and Brazil’s increasing proximity. Starting in the mid-2000s, the bilateral relationship has grown at an impressive pace. Since 2009, China is 1) Brazil’s number one trading partner, with the total flow traded between the two countries having tripled between 2006 and 2016, and 2) the primary destination for Brazilian exports. In 2017, close to 22% of Brazil’s exports went to China – almost double of the United States, in second place, at 12.3%. Besides trade, there has been an enormous upsurge in the volume of Chinese investments in Brazil. According to a recently published UNCTAD report, in 2017 “nine of the ten largest acquisitions by foreign companies [in Latin America] were in Brazil, and seven involved a Chinese buyer”. Assuming no abrupt ruptures in either country’s economic-political realities, the expectation is of a continuous – and most likely upward-moving – level of Chinese investment in Brazil for 2018.

Chinese Investments in Brazil

There is no firm number on how much China has invested in Brazil since it began its solid incursion in the country. There is a variety of databases, each one using their own timeline and method of assessment and presenting unique details of China’s investment in Brazil. Nonetheless, all available data equally point to at least two important findings. First, the volume of investment is undeniably substantial, both in absolute and relative terms. Second, the main sector receiving the investments has been energy. The following examples help illustrate such reality.

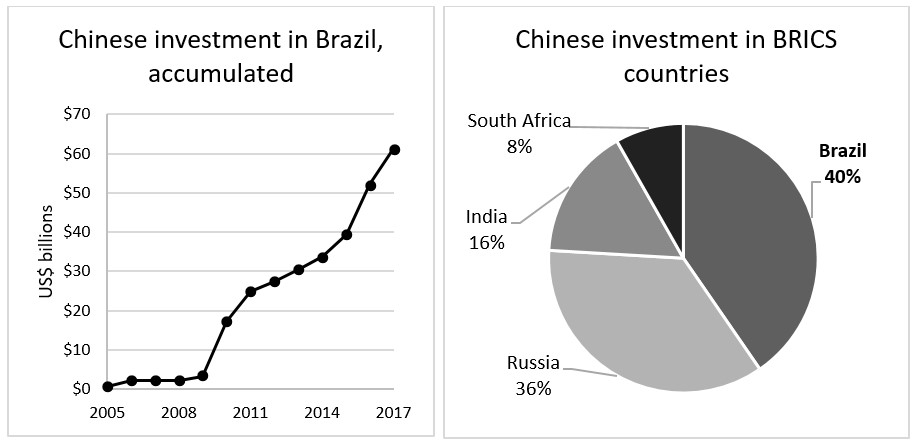

According to the China Global Investment Tracker, total Chinese investment in Brazil between January 2005 and January 2018 reached over US$ 61 billion. That places Brazil only behind the United States (US$ 173 billion), Australia (US$ 104 billion), and the UK (US$ 75 billion) in accumulated volume of Chinese investment during this period. According to the database, China’s investments in Brazil within this timeframe have represented 39% of all Chinese investment in South America, and 40% of all Chinese investment in BRICS countries. The energy sector alone encompassed almost 3/4th of the total volume invested. Adding investments in energy with those in agriculture and metals, and these areas concentrate 85% to all Chinese investment in Brazil.

Brazil’s Ministry of Planning also tracks Chinese investment in the country. Their database, which encompasses “confirmed” and “announced” investments, and spans from 2003 to December 2017, has the total volume of China’s investment in the country at US$ 124 billion, distributed in 250 projects. The sum of the 93 confirmed projects is US$ 53.5 billion, while the 157 announced projects amount to another US$ 70.5 billion. Energy and mining have accounted for over 85% of confirmed investments. Most of the volume has come from public enterprises (such as SINOPEC and China Three Gorges), responsible for US$ 87 billion (or 70%) of all investment confirmed and announced. Private companies have been responsible for over half of all confirmed projects. While not the biggest in volume, the automobile sector stands out for the number of individual projects: 18 confirmed and 39 announced.

Another set of numbers on China’s investment in Latin American countries comes from United Nations Economic Commission for Latin America and the Caribbean (ECLAC/CEPAL). In a recent report, their estimate puts China’s investment in Brazil between 2005-2017 at US$ 65.5 billion – the equivalent of 55% of all Chinese investment in the region. According to their assessment, during this period, China’s investments in energy in Brazil in renewable energy projects (especially wind and bioenergy plants) have grown at a stead pace of about US$ 7 billion per year. Also, while Chinese public-private partnerships (PPP) in Latin America have been relatively small – Chinese PPP in energy and transport represented just 1.3% of the total amount invested in the region by all countries in the same period – Brazil was home to almost two-thirds of these investments, and 99% of it was directed towards the energy sector.

Prospects of Continuous Growth

The growth of Chinese presence in Brazil has not occurred in a vacuum and is part of the Asian giant’s expanding global reach. This includes China’s deepening relationship with Latin America. As highlighted by its Foreign Minister Wang Yi during the second Ministerial Meeting of the China-CELAC Forum (which took place this past week in Santiago, Chile), even the Belt and Road Initiative is part of a joint effort to “open a path of cooperation across the Pacific Ocean that will better connect the richly endowed lands of China and Latin America and usher in a new era of China-LAC relations.”

Overlapping the China-Latin America connection, in June 2017, China and Brazil officially launched a US$20 billion fund (“China-Brazil Cooperation Fund for the Expansion of Production Capacity”), primarily focused at infrastructure and logistic projects in Brazil. The Fund was created with US$ 15 billion from China and US$ 5 billion from Brazil. Notwithstanding this uneven financial distribution, decisions over which projects to investment in will be made in a balanced fashion. And unlike what is frequently seen in Chinese projects in other developing countries, the Fund’s projects will not be tied to hiring Chinese workers or purchasing Made in China equipment. The Fund’s technical committee is scheduled to meet early February 2018, so updates should be emerging soon.

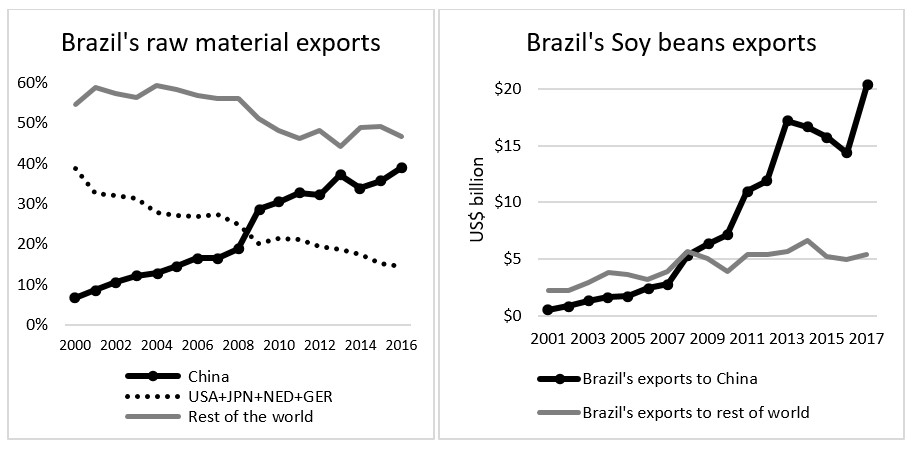

Complimentary structural strengths and weaknesses feed China and Brazil’s trade relationships. On the one hand, Brazil has an abundance of raw materials that China’s economy demands. The South American giant (Brazil is bigger than the continental United States), whose tropical climate allows for year-round yields, is one of the few large-scale global exporters of agriculture goods and livestock products. According to World Bank data, in 2000, China was the destination of 7% of Brazil’s raw materials, well below the combined sales to the United States, Japan, Netherlands, and Germany, all together at 39%. By 2016, the numbers had changed dramatically: China alone bought 39% of Brazil’s raw material exports, while the sum of the former four most important destinations had fallen to 14%. China is responsible for three out of every five dollars of imported soy beans in the world, and over half of what China bought of it in 2017 came from Brazil, with 79% of all Brazilian soy being exported to China. On the other hand, the 2008-2010 economic recession which affected Brazil’s traditional partners (US and Europe), coupled with the country’s own ongoing economic and political crisis since the early 2010s has had Brazilian leaders and business community scrambling for new and reliable markets, as well as capital to expand its productive and infrastructure capacity. China has provided a relief to both problems, albeit at a cost: Brazil’s accelerated deindustrialization.

Finally, Brazil’s presidential election, to be held in October 2018, is not expected to affect the bilateral relationship. From President Lula to Dilma Rousseff to Michel Temer, pragmatism has remained consistent, although the South-South framing has certainly been downplayed, at least from the Brazilian side. Foreign policy links and opportunities for collaboration have been strengthened in international fora, where Brazil and China have increasing worked towards mutual interests in the BRICS, BASIC, and G20, to name a few. In many ways, Brazil’s relationship with China now matters more than that with the US or Europe. And with President Donald Trump’s indifference towards most of Latin America (Mexico and Venezuela being the most visible exceptions), there are no visibly significant challengers to the growing relationship between China and Brazil. Still, only time will reveal the full economic and political ramifications – especially for Brazil, the weaker link in the dyad – of this partnership.

This article is published under a Creative Commons Attribution-NonCommercial 4.0 International licence.

Very good paper on Brazil-China economic relations! Congratulations!

I agree with your opinion regarding the pragmatism that has remained in bilateral relations in spite of changes that came to occur in the Brazilian government in the last four years.

FDI and financial flows from China to Brazil are really likely to grow in the near future.

Nelson Maia, economist/Brazil.

Great job!!