Geopolitical Economy of Russia’s Foreign Policy Duality: Lockean in its East and Hobbesian in its West

Download this article in PDF formatAbstract

At a time of critical geopolitical economic changes (i.e. power shift and new energy (dis)order), Russia has been pursuing different foreign policy lines in two sides of the Eurasian landmass: Lockean in its east and Hobbesian in its west. On the one hand, Russia has been intensifying its economic (i.e.energy) ties with Asia-Pacific, particularly with the rising great power China; on the other hand, it has been pursuing aggressive policy against Western powers’ interests in its west (i.e. Georgia, Ukraine, Syria). How do we explain this discrepancy of Russian foreign policy? How do those geopolitical economic changes interact with aspiring great power energy giant Russia’s foreign policy orientations? Is there any role for leader level perceptions on the country past and future? In order to answer those daunting, but complementary questions requiring different levels of analyses, this paper draws on a neoclassical realist perspective bridging the divide between domestic-international (spatial), ideational-material (cognitive), and temporal (part-present-future). In this light, it argues that at a time of profound global changes, Russian elites’ geopolitical economic perceptions of their country’s role in the Eurasian landmass have been causing this duality in its foreign policy. The paper concludes that Russian elites’ sense of geopolitical exposure and their economic mismanagement have not only prompting discrepancy in Russia’s foreign policy, but also undermining its great power status in the 21st century.

Keywords

The collapse of the Soviet Union was the greatest geopolitical catastrophe of the century – President Vladimir Putin

If Peter the Great lived now, he would undoubtedly build the capital not in the Baltic region, but at the Pacific Ocean – Prof.Sergei Karaganov

Introduction

Due to “global power shift” (Hoge 2004) induced “systemic change”1, the political-economic weight of the Asia-Pacific region (APR) – primarily led by China- has been increasing. Those global “geopolitical economic”2 changes have been reshaping “hierarchy” of international politics3, thereby, providing significant opportunities/challenges to the system’s “secondary powers” (Williams,et.al. 2012). At a time of new energy (dis)order (i.e. changing trade balance, price volatility, American led “unconventional energy revolution”), this is particularly the case for the “aspiring great power” Russia (Rangsimaporn 2009; Mankoff 2012). As one of the largest energy exporting countries with shrinking European market, Russia dreams of regaining its powerful status in its east, namely “Eastern Vector” or “Pivot to Asia” aims to exploit untapped potential resources – particularly in East Siberia and the Russian Far East (ESRFE)- and exporting them to the widening Asia-Pacific market through Lockean logic.4 Moreover, Sino-Russia military ties have reached “at all time high” culminating in Joint Sea 2016 exercises took place in the disputed South China Sea (RT, 2016). In its west, however, Hobbesian culture dominates the minds of Russian policy makers prompting them to go aggressive in the perceived “Near Abroad” (i.e. Ukraine) and more recently in the Middle East, particularly Syria. To put bluntly, both Hobbesian and Lockean logics haunt the minds of Russian policy makers simultaneously, thereby, push Russia’s foreign policy to divergent, if not contradictory, directions.

In this light, the paper’s research questions are as follow: How do we explain this discrepancy of Russian foreign policy? How do those geopolitical economic changes interact with aspiring great power energy giant Russia’s foreign policy orientations? Is there any role for Russian elite geopolitical economic perceptions on the country past and future? In order to answer those questions, this paper draws on a neoclassical realist perspective bridging the divide between domestic-international (spatial), ideational-material (cognitive), and temporal (present-future), it argues that Russian elites’ geopolitical economic perceptions interacting with the country’s resource rent based economy cause discrepancy in Russia’s foreign (economy) policy. The plan of the study is as follows: Drawing on a neoclassical realist account, the first part provides a geopolitical economic conceptual framework to discern how interacting geopolitical perceptions of state elites and dominant economic sector – for our purposes energy sector- serve as a foreign policy determinant. The second part hinges on two geopolitical economic changes in the international system level – power shift to east and new energy (dis)order –providing both opportunities and challenges for Russia with its resource rent based economy. The third part will shed light on Russia policy-making elite perceptions on aforementioned changes in the international system level and Russia’s today and future in this emerging geopolitical economic setting. Moreover, it stresses upon energy sector component of Russia’s pivot to Asia as an attempt to adjust itself to those aforementioned geopolitical economic changes. The last part illuminates how Russian sense of geopolitical exposure in its west and mismanagement of its resource rent economy challenges Russia’s resurrection. It concludes that both sense of geopolitical exposure and economic mismanagement have been pushing Russia’s foreign policy in two diverse directions: Lockean in its east and Hobbesian in its west.

Geopolitical Economy and Foreign Policy: A Neoclassical Realist Account

P.Kennedy’s (1989) seminal study titled “The Rise and Fall of the Great Powers” reveals how economic indicators enable researchers to discern which powers were rising, while others were falling in a time period between 1500 and the 1980s. He puts that ascendancy of powers correlate with their economic duration and available resources. Similarly, J.Agnew and S.Corbridge put that “today, as at certain times in the world (for example period between 1500 and 1700 in Western Europe) relative economic power has begun to displace military force and conquest as an important feature of international relations” (Agnew and Corbidge 1995,p. 3-4). As (economic) globalization proceeds in the post-cold war period, even some pundits assert that the world to grow increasingly “flat” (Friedman,2006).

Without a doubt, globalization has been one of the most important characteristics of international relations; however, one should not exaggerate its magnitude and implications on states’ foreign policy orientations. As R.Gilpin (2001,p.18) reminds us, in along with economic efficiency, national ambitions such as gaining [great power] status are driving forces of globalization and “the economic/foreign policies of a society reflect the nation’s national interest as defined by the dominant elite of that society.” Even at a time of accelerated globalization, states endeavor to expand their influence over energy resources (such as oil and natural gas) and trade routes (e.g., critical energy infrastructures, sea lanes) for strategic objectives. As we will discuss below, this is particularly the case in (immobile) energy resources, which could be acquired from a fixed range of geographical locations (i.e.Russia) that are relatively close to rising powers with increasing imported energy needs (i.e.China) in the Eurasian landmass.

Hence, conversably to critical geopolitics’ “anti-geopolitics” and “anti-catographic” stance (Kelly 2006; Haverluk,et.al.,p. 2014), a holistic geopolitical toolkit would provide relevant and more explanatory analyses to examine how geopolitical economy shapes a given states’ foreign policy orientations in the 21st century. In this regard, through its emphasis on domestic factors such as elite perceptions , state-society relations and state motivations in along with relative material considerations in the international system, “neoclassical realism” (NCR) could illuminate the role of geopolitical economic determinant of Russian foreign (economic) policy. G.Rose (1998) summarizes NCR’s principal contentions to bridge the domestic (unit-level) –international (structure) spatial gap with these words:

“[Neoclassical realisms’] adherents argue that the scope and ambitions of a country’s foreign policy is driven first and foremost by its place in the international system and specially by its relative material power capabilities…They argue further, however, that the impact of such power capabilities on foreign policy is indirect and complex, because systemic pressures must be translated through intervening unit-level variables [such as decision-makers’ perceptions and state’s economic structure]” (Rose 1998,p.146).

In a review article on NCR, M.Foulon (2015,p.653) notes that in along with bridging spatial (domestic-international) gap it fills cognitive (material-ideational), and temporal (past-present-future) divides as well: “state-level assessments and imaginations about future material capabilities create the geopolitical contours for the formation of foreign policy.”

This phenomenon is particularly important for aspiring great power energy giant Russia at a time of critical geopolitical economic changes5 (i.e.power shift to east and new energy (dis)order) in the 21st century. Before examining how those geopolitical economic changes have been shaping Russia’s foreign policy, it would be plausible to elaborate on those geopolitical economic changes.

Geopolitical Economic Changes in the 21st Century

“Power shift to east” and “new energy (dis)order” have emerged as the two prominent underlying geopolitical economic changes for aspiring great power Russia’s foreign (economic) policy in the 21st century. Before examining how those systemic changes have served as inputs to Russia’s foreign (economic) policy output, it would be plausible to shed light on how those profound changes have been (re)shaping hierarchy of international politics in general, Eurasian politics and Russian foreign policy orientation in particular.

Power shift to the east and China’s (re)emergence

The debate on the United States (US) as a declining power and the rise of Asia has been around since the late 1960s. Among those studies, one should note Frank’s “ReOrient” through a historical-structuralist perspective. In his study, Frank postulates the re-orientation of global political economy towards Asia with these words;

“‘Leadership’ of the world system…has been temporarily ‘centered’ in one sector and region (or a few), only to shift again to one or more others. That happened in the nineteenth century, and that appears to be happening again at the beginning of the twenty-first century, as the ‘center’ of the ‘world economy seems to be shifting back to the ‘East’” (Frank 1998,p. 7).

Indeed, this phenomenon has become evident in the 2000s, mainly due to the rise of China which has discovered “the seven pillars of Western wisdom”6 (Mahbubani 2009,p. 51-100) underpinning the West’s progress and its success in outperforming Asia for the past two centuries. Among those studies, F. Zakaria’s (2008) The Post-American World asserts that “third great power shift” in which “the rise of the rest,” has been coming to pass in our times.7

The debate has been reinvigorated following American led global financial crisis in 2008 (Mahbubani 2009; Fouskas and Gökay 2012). Following their analysis on variety of data and projections provided by Carnegie Endowment, Price Water House Coopers, and National Intelligence Council (NIC), Fouskas and Gökay (2012,p.126) put that “the current [American led] financial crisis, and economic downturn will confirm and possibly accelerate the shift in economic power to Asia, in particular China.” Mainly due to the success of its socialist market economy as economic development model, rising China overcame from the crisis with minimal negative impacts and became the second largest economy in 2010 (Atlı 2013). Differently expressed, the crisis underlined China’s position as the engine of not only the Asian regional economy, but also the global economy (Xinbo 2010). From Beijing’s perspective, China has been re-emerging to its rightful place in the international system, arguably harbingering “a return to geopolitical business as usual” (Beeson and Li 2015,p.94).

Compounded by its historic “strategic mistrust” (Jisi,et.al.2012), Beijing believes that the US’s principal objective is to maintain its global hegemonic status, thereby; Washington will attempt (i.e. democracy agenda, maritime control of South Sea and Yellow Sea, arm sales to Taiwan, economic protectionism, TPP, etc.) to prevent re-emergence of China. Some high-ranking Chinese officials even have gone far and openly asserted that “the United States is China’s greatest national security threat” (Jisi,et.al. 2012,p.13). Nonetheless, this does not entail China to take aggressive steps to jeopardize its “superficial friendship” (i.e. pretending to be friends despite conflicting interests) with the US at the expense of its “peaceful rise to great-power status” (Bijian 2005; Xuetong 2010). In this context, the authors of the article concur with W.Dong argument that “China has been pursuing a hedging strategy that aims at minimizing strategic risks, increasing freedom of action, diversifying strategic options, and shaping the US’ preferences and choices” (Xuetong 2010,p.59). In this parallel, continental power China “marches westwards” through the Silk Road Economic Belt (SREB) and variety multilateral/bilateral initiatives – for our purposes intensified (energy) relations with Russia – to consolidate its rising status, improve its international environment, and promote regional cooperation in the Eurasian landmass (Zhao 2015), rather than practicing “Monroe Doctrine” in its backyard (Navarro 2014).

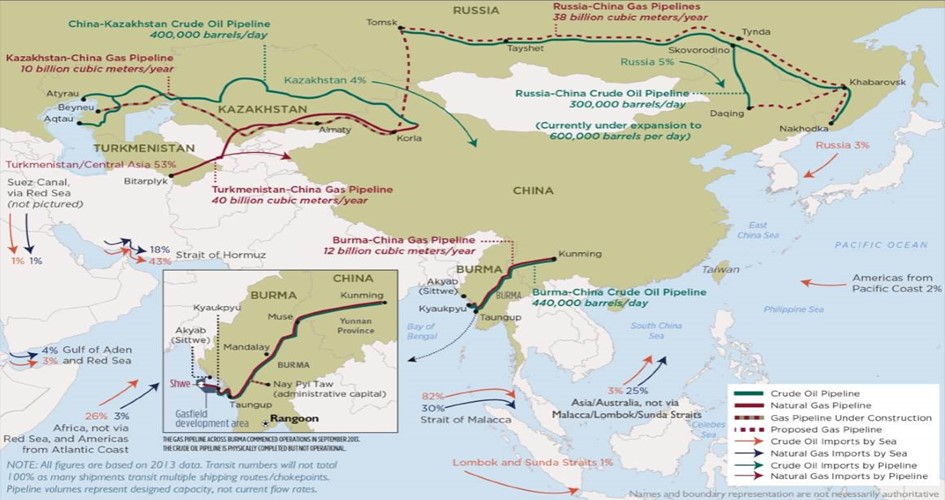

Fueling China in the New Energy (Dis)Order

China believes that it is a rising power on the way to become the world’s largest economy. However, it has an enormous problem: energy needs (Bender and Rosen,2015). To put differently, it is vital for China to ensure uninterrupted flow of affordable energy resources to its growing economy. According to BP’s projection, ongoing economic expansion in Asia – particularly in China and India – will drive continued growth (an average of 1.4% annually) in the world’s demand for energy over the next 20 years (BP). As the world’s most populous country with a fast-growing economy, China has become the world’s largest net importer of petroleum and other liquids, in part due to its rising oil consumption by 2013. Its oil consumption growth accounted for about 40% of the world’s oil consumption growth in 2014 (EIA). By 2030 it is projected that China will become the world’s single largest hydrocarbon importer (80% of its oil and more than 40% of gas consumption) (Energypost). Besides to its substantial oil demand growth, geopolitical uncertainties in those principal oil exporter regions (i.e. Middle East) have led China to import greater amounts of crude oil from a wide range of sources. Nevertheless, it still heavily dependent on oil imports (about 50-55%) from the Middle East and beyond that about 43% of this oil has to navigate through the Strait of Hormuz while 82% of all Chinese maritime oil imports must pass through the Strait of Malacca (Bender and Rosen 2015), in along with deeply destabilized South and East Asia seas. Natural gas consumption in the country has also risen tremendously over the last decade, and China has sought to increase natural gas imports as liquefied natural gas (LNG) passes through aforementioned various fragile chokepoints as well (MAP 1).Accompanied by its “strategic mistrust” of the sea-power US controlling maritime (energy) trade and energy rivalries with American Asian allies (i.e. India, Japan and, S.Korea), continental power China has been exposed to growing levels of “geopolitical risk” at a time of “shifting energy trade balances”(Newell 2013,p.39). As a part of securing China’s commercial – for our purposes energy- lines of communication (SLOCs), China has been modernizing its navy forces with a limited but growing capability (Rourke 2016,p.7). With its potential to transform geostrategic character of the whole region, moreover, China has come up with Maritime Silk Road Route initiative, which is a reflection of Chinese growing interests in Indian Ocean ports and projects to construct new overland secure pathways to link China with the Indian Ocean (Brewster 2016).

Energy related “geopolitical risk” is not the sole concern for China though; it has been confronted with “price risk” as well. In the last decade, indeed, by creating a climate of uncertainty and distrust among energy actors, energy price volatility has become the most significant issue facing the global energy industry (Henning,et.al.2013). Actually, the title of World Energy Council’s (WEC 2015) last report is “Energy price volatility: the new normal”. In this light, this new energy (dis)order has rendered resource rent based economies such as Russia much more vulnerable.

By enabling to reach previously untapped reserves of oil and gas due to technological advancements, it is expected that “the revolution” will transform the world’s regional supply dynamics (Maugeri ,2012). Indeed, it is projected that the US will turn out to be the largest oil producer by the mid-2020s and a net energy exporter by 2030s. The EIA (2012) also estimates that American gas production – increasing from 650 billion cubic meters (bcm) in 2011 to 850 bcm in 2035 – will exceed production rates of Russia. This means that the US’s increasing amount of LNG importer position has been shifting to a net LNG exporter with potential triggering effects on spot market prices, the global LNG market, and international price structures for natural gas contracts. Although its impact has been less pronounced than shale gas, the North America’s unconventional oil reserve potential (oil sands/tight oil) would likely to cause similar ramifications in global oil markets (Newell and Iller 2013,p. 27). This surge in oil production, in addition to fluctuations in financial markets, is considered among primary reasons for 40% sharp price fall in the period between June 2014 and December 2014 (Economist 2014, Özdemir 2014). Besides to fluctuating prices, those abundant unconventional source discoveries in North America, combined with global demand patters emanating from APR, will likely to transform the globe’s energy trade balance (Newell and Iller 2013, p.39). In words of energy guru D. Yegin; “the emergence of shale gas and tight oil in the US, demonstrates once again, how innovation can change the balance of global economic and political power” (Yergin 2014).

Before assessing geopolitical economic implications of this new energy (dis)order, it would be plausible to note three main characteristics of the “revolution” 1) Production growth continues to be driven by North America; 2) Slow down after about 2020 3) Other countries will enter the game – notably Russia and China– but their contribution will be limited (Rühl 2014). In this context, it is safe to propose that by having the strategic card of becoming a net energy exporter, the US is the biggest winner. Considering there will be more supplier options in the energy markets with depressed but fluctuating prices, the European Union (EU) with a decline in growth levels (i.e. with or without European shale gas revolution) has proposed measures (i.e. efficiency, completing energy markets, diversification) to decrease its dependence (around 30-35% in natural gas) on Russian resources as indicated in its Energy Security Strategy paper published in response to the most recent Ukrainian crisis (European Commission 2014). In this parallel, pointing out the US led “unconventional energy revolution”; several pundits have proposed forthcoming American energy exports to EU energy market (Cheney 2014). As a more concrete step for diversification away from Russia, the EU has put its political will on the Southern Gas Corridor that is envisaged to import non-Russian natural gas reserves of Caspian Basin – Azerbaijan’s Shah Deniz II gas field being in the first place- via Turkey through TANAP and TAP. In light of these favorable developments on the importer side with depressed but fluctuating prices, Russia, with its economy based on energy rents and narrowed EU market, is one of the losers in the new energy (dis)order. As it will be elaborated below these energy developments have reinforced aspiring great Russia’s eastern vector.

Aspiring Great Power Russia’s Geopolitical Outlook in the New Century

Unlike other major powers (the US, the EU, China), Russia’s great power status has been largely diminished from its superpower status in the second half of the twentieth century (Kuchins and Zevelev 2012,p.181). In this light, it is not a surprise to note that at one of his speeches responding to western criticisms on Russia’s democratic credentials, President Vladimir Putin stated that “the collapse of the Soviet Union was the greatest geo-political catastrophe of the century” (Independent 2005). This statement of Putin is a clear reflection of Russian elite’s traditional mindset utilizing geopolitics as the primary tool of (re)orienting Russia to changing international system. By dividing world into pan-regions (i.e. the near abroad, Europe, Asia), Russia determines international power balance or defines “natural” allies (Leichtova 2014,p.18). To put differently, Russia embarks on creating coalitions to balance the influence of the dominant power block (the West in general, the US in particular) allowing partnering with states (i.e China) all around the world that corresponds “the multi-vector” of its foreign policy. Putting itself in the role of “balancer” (just like Great Britain between the 17th and the 19th centuries) without no eternal friends and enemies in the system, Russia has been placing its own capabilities (i.e. military and energy sectors) to lure those partners not to orient towards the unipolarity under the US (Leichtova 2014,p.25).

This geopolitical outlook correlates with Russia’s ambition to (re)gain great power status that is directly linked with its geographical positioning and physical characteristics of the Russia as a security state, which should be powerful to avert prospective threats (i.e. military, separatist groups) that might endanger integrity of its extensive territories in the Eurasian landmass. In this context, following the footsteps of the architect of Russia’s multi-vector foreign policy with frequent emphasis on “multi-polarity”, former Prime Minister Yevgeni Primakov, President Putin has the vision of transforming Russia into an indispensable great power through “economic modernization” [for our purposes energy sector] and independent foreign policy (Mankoff 2007, 127). To put differently, Kremlin’s main objective is to ensure Russia’s territorial integrity by paying close attention to domestic concerns (i.e. economic modernization) in eastern regions (i.e.ESRFE), preventing intra-state conflicts (i.e.fundementalsim and separatism), facilitating economic cooperation [particularly in energy sector] with all Eastern states (i.e. China), regardless of their ideological disparity (Rozman, 1999: 5-6; Belokrenitsky and Voskressenski 2004,p. 90). Through strengthening central authority such as “Yukos Affair” in energy sector (Balzer 2005), those efforts have produced positive results in terms of managing internal political-economic disorder, reducing intra-state armed conflicts, and restoring a decent level of social-economic development ( Kireeva 2012,p.54).

In foreign policy sphere, Moscow has embarked on pursuing a more independent approach to dealing with the rest of the world. Along with Putin’s leadership type and a broad elite consensus about the role that the state should play, an increase in Russia’s relative international power – mainly due to incrementally increasing energy revenues and declining American hegemony- have shaped Russia’s new foreign policy approach (Mankoff 2012,p. 4-5).

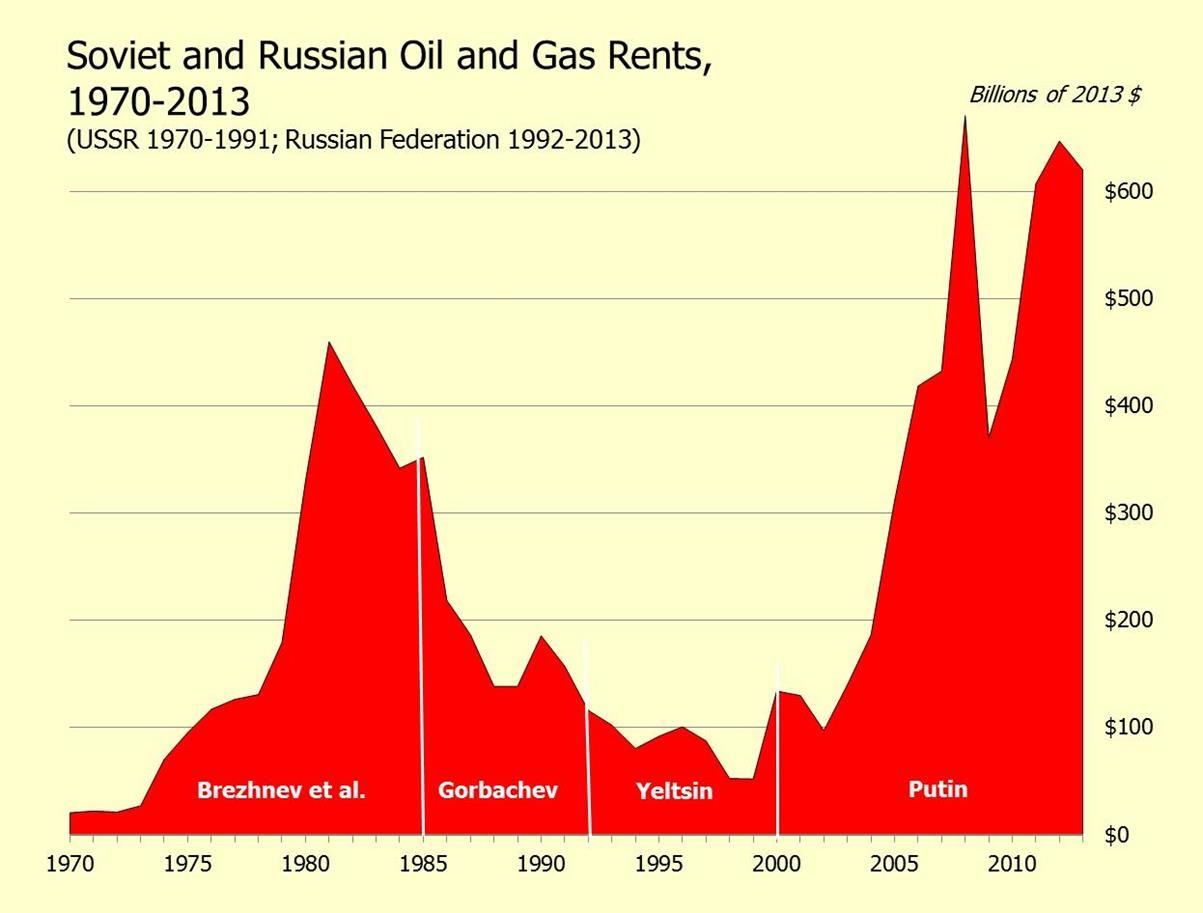

Figure 1: Soviet (1970–1990) and Russian (1991–2013) oil and gas rents (Billions of 2013 USD)

According to Putin’s vision, “Great-power status is…a necessary condition for Russia’s more advanced engagement with the world ” (Tsygankova 2005,134). With “the greatest fear” that the emerging new geopolitical setting in which the world’s major economic powers would be capable to topple down Russia, as an aspiring great power, it has been in a state of transition for geopolitical position and role in the international system (Morozova 2009; Grvosdev and Marsch 2013,p. 4-6).

As it aims to regain its great power status, among Russians there has been a shift of understanding that economic factor, particularly energy wealth, rather than military one, is the primary component of Russia’s power in the era (Grvosdev and Marsch 2013,p. 7). In this context, Russia is ready to make whatever it is necessary including changing its foreign (economic) policy orientation or geostrategy. The Foreign Policy Concept (2008), indeed, delineates Russia’s foreign policy objectives with these words

“…to preserve and strengthen its sovereignty and territorial integrity, to achieve strong positions of authority in the world community that best meet the interests of the Russian Federation as one of influential centers in the modern world, and…to create favorable external conditions for the modernization of Russia…”

“Will to derzhava” (urge to great power status) prevalent among Russian elites as well and this paves them to prescribe policies to restore Russia’s “rightful” position – third big player following the US and China – in the international system which is evolving to the multipolarity. In other words, isolationism is not an option for Russia (Grvosdev and Marsch 2013,p. 6).

As it will be discussed below, there are downsides of Russia’s geopolitical position and energy sector [and military sector] dependent economy. Fortunately, they also provide Russia the opportunity to reorient its west oriented geostrategy towards other ventures. Historically, much of Russia’s economic activity and population have been concentrated in the western part or the so-called European Russia stretching from the Ural Mountains. It is mainly due to the fact that in the last 300 years, Western and European civilizations have been located at the world’s political-economic center of gravity. Most recently, thanks to the blessing of its strategic location between Asia and Europe, Russia is set to shift its orientation as power shifts to APR, which could provide resources for the development of those Russian distant places that “communist planners left out of cold”, ESRFE (Hill and Gaddy 2003). As indicated in the Foreign Policy Concept (2013):

“Strengthening Russia’s presence in …APR is becoming increasingly important since Russia is an integral part of this fastest-developing geopolitical zone, toward which the center of world economy and politics is gradually shifting. Russia is interested in participating actively in APR integration processes, using the possibilities offered by the APR to implement programs meant to boost Siberian and Far Eastern economy…”

Indeed, Russia’s aptitude to cooperate with rising Asian powers (i.e.China) would determine its prospects to maintain its current position at worse, its revival as a great power in international power hierarchy – the third biggest player – at best, in the new geopolitical setting of the twenty-first century. Despite concerns of becoming too dependent and open to geopolitical exposure on China – as will be discussed below – and deteriorating relations with the West at least before the Ukraine crisis, Russia perceives great political-economic potential in its growing partnership with China, which is a natural soulmate on many critical foreign policy issues rendering Russia strong (Legvold 2006). Indeed, through geopolitical lenses, both Russia and China prefers a multi-polar world, rather than the US led unipolarity. On the one hand, Russia considers partnership with China as an opportunity to pursue multi-vector policy to counterbalance the West. China, on the other hand, sees its rapprochement with Russia as an additional hand to offset the US in the Asia-Pacific. Paradoxically, the US serves as a separator factor in their relations as well. This primarily stems from China’s relation pattern with US, which is both strategic and largest trading partner for the former at the same time. Contrary to its economic ties with the US, Sino-Russian economic interdependence is limited though, arms trade has the lion share in the trade volume (Russia is the second largest arm exporter to China) and energy trade is growing (Calrlsson,et.al.2015). Energy sector will likely to provide the primary propulsion for Russia’s pivot to Asia.

Energy Dimension of the Eastern Vector

Considering that “when a vector joins with a sector, we can see the emergence of foreign policy” (Grvosdev and Marsch 2013, p.10), its dominant energy sector (in along with the military) – contradicting with elite concerns on empowering China though- propel Russia to prioritize its Eastern vector. As Tsygankov (2009) notes, the pro-China position is often favored by energy producers [and military enterprises] seeking feasible contract in growing Asia markets.

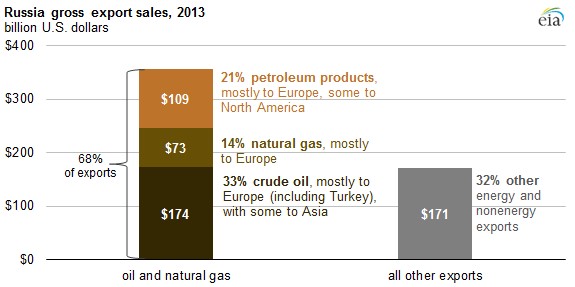

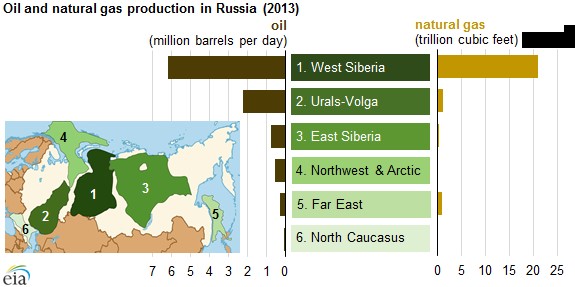

As a major producer/exporter of oil and natural gas, Russia’s economy heavily relies on its energy exports (Figure 2). In 2012, its energy revenues accounted for 52% of federal budget and over 70% of total exports (EIA). In 2013, Russia’s oil production was 10.788 million barrel per day (bbl/d); it’s the annual natural gas production of 604.8 billion cubic meters (bcm). Significant portion of those resources have been exported, rendering Russia the world’s largest oil and gas exporter in total (BP 2015).

Figure 2:

Connected with a variety of oil and natural gas pipeline, historically, Europe has been the main energy partner for Russia. Although Russian energy companies in the 1990s endeavored to diversify away from European market, they did not get the required support from of the Russian state. Today, however, Russia prioritized market diversification (i.e. the Asia-Pacific) and stress on developing resources of “the East’s step-son” (i.e. Eastern Siberia and Russia Far East) (Balzer 2005 ; Pussenkova 2009). As it loses its market share in the European market, Russia expects to increase its share in Asia-Pacific energy market by 2030: from 8% to 25% in oil, from 0% to 20% in natural gas (Energystrategy.ru).

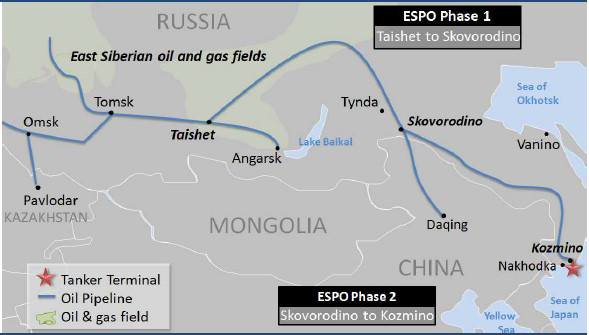

Despite declining rates of production over more than 40 years of operation, West Siberia – notably from the Priobskoye and Samotlor fields – continues to provide bulk of oil supply. In the longer term, however, Sakhalin in the Far East, which contributes only 3% at the moment, along with the untapped oil reserves in Eastern Siberia and the Russian Arctic, is expected increase its share in total production figures (Map 2-4) (EIA). With this optimistic production figures, overshadowing all other projects of the post-Soviet era Russia, in December 2009, the first leg of East Siberia Pacific Ocean (ESPO) pipeline became operational to connect Daqinq Skovorodino in Siberia to the north-east of China. On December 25, 2012, ESPO-2 has become operational to link Skovorodino to Kozmino oil terminal with an annual capacity of 35 million tons (Map 3). This two legged pipeline project will not only enable Russia to diversify its energy markets in Asia, but also, arguably more importantly, bolster prospects for development of ESRFE. Indeed, President Putin asserted that the new pipeline section will “considerably increase the infrastructure capacity of the regions in Russia’s Far East” and considered the commissioning a “significant event” (Rousseau 2013).

In natural gas, Urengoy, Yamburg and Medvejye, known as “the big three” located at Northwest and Arctic, are the largest fields with declining production rates though. The oil and natural gas deposits in Yamal Peninsula have also considerable potential. Yamal liquefied natural gas (LNG) project aims to access Asian markets after 2017 (Novatek.ru). The country’s current LNG exports are made from Gazprom led Sakhalin 2 LNG project. In along with ongoing “upstream” investments in Sakhalin, those deposits in Arctic /East Siberia have been appealing increasing attention from the world energy sector. Even though production costs are much higher in comparison to the rates in Western Siberia, they appear as the sole factor to compensate declining production figures. Particularly in the Arctic area, there has been going on a fierce competition, partly due to emerging “Northern Sea Route” -as glaciers melts- with potential to change the world’s trade routes as transporting goods to Asian economies will be much shorter and less costly.

Recently, Russia has passed an important threshold to process and export Eastern Siberian natural gas to Asia-Pacific markets. Accordingly, on May 21, 2014, the Russian Gazprom and the Chinese state oil company CNPC signed a 30 year termed purchase and sale gas agreement stipulating annual maximum sale of 38 bcm commencing by 2018. Arguably, this Sino-Russian agreement has been a response of Gazprom to the US led “shale gas” revolution and future export prospects of those unconventional resources to world energy markets notably European and Asian.

Challenges for Aspiring Great Power Russia

As power shift to east has been (re)shaping the world, aspiring great power Russia has been endeavoring to readjust itself to these new geopolitical economic changes by reorienting its foreign (economic) policy towards the east primarily through its energy sector. In its venture, however, there are two major challenges on Russia: sense of geopolitical exposure and modernizing its resource rent based economy.

Sense of Geopolitical exposure

Due to its control of vast territories in the Eurasian landmass, in terms of the length of its borders and number of neighbors (the US, Japan, Korea, China, and the EU), Russia is the world’s most “exposed” country. Accompanied by historical invasions, its geographical insecure land power status has prompted Russia (and its predecessors) to establish “buffer zones” (Gvosdev and Marsh 2013,p. 5), conceptualized as “near abroad” (Secrieru 2006; Trenin 2009; Camerona and Orenstein 2012) in variety official documents. Referring to Western geopolitical thinkers, R.Kagan (2012,p.155) elaborates,

“Russia is the world’s preeminent land power… Land powers are perennially insecure, as Mahan intimated. Without seas to protect them, they are forever dissatisfied and have to keep expanding or be conquered in turn themselves. This is especially true of the Russians, whose flat expanse is almost bereft of natural borders and affords little protection.”

On the western flank, the East-West energy corridor (i.e.BTC oil pipeline, TANAP,etc.), Western sponsored color revolutions, NATO’s Kosovo intervention, missile defense system, NATO/EU’s enlargement/good neighborhood /the Eastern partnership/association agreement policies towards it’s “near abroad” have justified Russia’s geographical sense of insecurity. Therefore, the Ukraine crisis (2014-), just like the Georgian crisis in 2008, has not erupted out of thin air and served as “the last straw” (Trenin 2014,p. 14) for Russia’s security considerations with far-reaching geopolitical repercussions for Eastern Europe and beyond. Regardless of popular arguments in the West overstating Russia’s imperial impulses and/or personal ideological commitments over the last crisis, President Putin castigated Westerns’ neglect to treat Russia an equal partner and take into account its security interests with these words:

“[Western states] are constantly trying to sweep us into a corner because we have an independent position, because we maintain it and because we call things like they are and do not engage in hypocrisy. But there is a limit to everything. And with Ukraine, our western partners have crossed the line, playing the bear and acting irresponsibly and unprofessionally” (Washingtonpost 2014).

In this parallel, citing S.Huntington’s widely discredited assertion that “For self-definition and motivation, people need enemies” (Huntington 1997, p.130), S.Charap and K.Darden (2014,p.7) put that “after 25 years of the West treating Russia as an enemy in Ukraine, Moscow might have really become one.” Criticizing the West’s “liberal delusions” for igniting those two crises, J.Mearsheimer (2014) reminds that “This is Geopolitics 101: great powers are always sensitive to potential threats near their home territory.” Moscow is clear on what it does not want in its proximity: national security threat, dismantlement of its bilateral economic relations, external assistance to anti-Russians, political-economic instabilities, precedents of Western orchestrated movements toppling down pro-Russian governments (Charap and Darden,2014:10).

Besides to those aforementioned material concerns, arguably, ideational considerations (i.e. status, prestige, reputation etc.) have played their role as well. Since the end of the Cold War, as Larsona and Shevchenko put, Russia has displayed anger at American unwillingness to grant it the status to which it believes it is entitled, especially during the 2008 Russo-Georgian War, and most recently Russia’s takeover of Crimea and the 2014 Ukrainian Crisis (Larson and Shevchenko, 2014). In this parallel, pertaining Russia’s pro-Assad regime stance in the Syrian Crisis, A.Bagdonas (2012) argues that it was primarily motivated not solely by material interests, but also by the foreign policy doctrine of multipolarity and the wish to maintain influence and reputation in the region. President Putin, indeed, remarked that “At first they talked about the need to isolate Russia after the well-known events, for example, in Crimea. Then it became clear that this is impossible, and with the beginning of our operations in Syria the understanding of the impossibility of such destructive actions against our country became completely obvious…” (RT 2016).

Economic Modernizing through resource rents?

Following the collapse of the USSR, the ESRFE have been suffering from de-industrialization and de-population as China increase its presence (Rousseau 2012). In this regard, it is vital for Russia to achieve those eastern provinces’ “dual integration”, holding them as parts of the country and integrating them with the growing Asian market. In this regard, G. Chufrin concerns about the loss of Russian sovereignty over those territories, mainly due to its poor [economic] governance (Cited in Poussenkova 2009, p.136).

Notwithstanding Moscow’s optimism that private sector would make the required investments to develop idle regions under harsh climatic conditions, Russian economy is far from providing proper business climate for feasible investments, thereby, cannot prevent capital outflows at high rates (Yanık 2013, p.237). This also the case for the country’s energy sector in which the increasing level of governmental control and the limitations imposed on both domestic private producers and foreign investors have been curtailing investments (Khrushcheva 2012).

Against this backdrop, solving its “Eastern Question” through providing fertile ground for investment is one of the most challenging tasks for Russia. At a time of the Ukraine crisis/annexation of Crimea related Western sanctions imposed on Russian economy (for our purposes energy sector), has further curtailed its prospects to finance/attract required huge (energy) infrastructure investments (i.e.new pipelines, refineries, LNG plants,etc.) to foster development in those provinces. To make things more complicated, the plunging oil prices have been hitting resource rent dependent Russian economy much harder than those sanctions (Birnbaum 2014). This reminds us how Russia is vulnerable to fluctuating energy prices and this jeopardy puts financial restrictions to modernize its economy (Connolly 2011).

Another risk associated with Russia’s dependence on its energy sector relates to its pitfalls to exert political economic influence in the eastern vector. Partly due to “the non-conventional energy revolution”, Russia will be increasingly faced with harsh competition with other LNG exporters– especially Australia and Middle Eastern origin, namely Qatar – to access Asia-Pacific energy market that has already diversified its imports (Victor 2013,100). Following the nuclear deal with P5+1 countries, Iran will provide additional energy supplies to those markets with depressed prices at the expense of Russia’s energy sector (Mills 2015) . To put differently, Russia will be one of the many energy suppliers with limited political-economic influence. Indeed, April 2013 dated Russian Science Academy’s report warned Russia would have difficulty of finding customers willing to pay reasonable prices for its energy exports, posing a risk to its energy sector and the economy (Eriras.ru). As its relations with the West has further strained, this risk has escalated as well, particularly on price negotiations favoring China (Panin 2014). Hence, “Russia’s pivot to Asia is being reduced to a pivot to China” (Hedlund 2015).

Conclusions

As “power shift to east” and “new energy (dis)order” have been reshaping the world’s geopolitical economic landscape, thereby, changing “hierarchy” of international politics, this paper has aims to find answers to the following questions: How do we explain this discrepancy of Russian foreign policy? How do those geopolitical changes have been interacting with aspiring great power energy giant Russia’s foreign policy orientations? Is there any role for Russian elite geopolitical economic perceptions on the country past and future? In order to answer those daunting questions requiring different levels of analysis, this paper drew on a neoclassical realist account and argued that at a time of profound geopolical economic changes Russian elites’ perceptions of their country’s role in the Eurasian landmass have been causing this duality in its foreign policy.

In order to materialize its objective, the outline was organized as follow: Drawing on a neoclassical realist account, the first part provided a geopolitical economic conceptual framework to illuminate how interacting geopolitical perceptions of state elites and their (mis)management of the country’s energy sector – for our purposes energy sector- serve as a foreign policy determinants for Russia’s foreign policy. The second part proposed that two geopolitical economic changes in the international system level – power shift to east and new energy (dis)order –have been providing both opportunities and challenges for Russia with its resource rent based economy. The third part revealed Russia policy-making elite perceptions on aforementioned changes in the international system level and Russia’s today and future in this emerging geopolitical economic setting. Moreover, it stresses upon energy sector component of Russia’s pivot to Asia as an attempt to adjust itself to those aforementioned geopolitical economic changes. The last part illuminated how Russian sense of geopolitical exposure in its west and mismanagement of its resource rent economy have been challenging Russia’s resurrection. Against the backdrop, the paper concludes that it’s perceived “geopolitical exposure” – particularly in its west and to a lesser extent its east- “problems of modernizing its economy through resource rents” not only pave Russia to play dual roles in its foreign policy, but also, arguably more importantly, curtail its prospects to retain its great power status at a time of critical geopolitical economic changes.

Beyond the scope of this paper, several critical questions come to mind: Should we treat Sino-Russian energized partnership as an anti-Western block? Is APR becoming a new scene for “tragedy of great powers”? The answer of the authors to those questions is not necessarily though. Regardless of its “strategic mistrust” and clashing perspectives (i.e. maritime control, vulnerable financial system, currency rates, etc.), China would not like to hurt its “peaceful rise” that is based on its intense relations with the global hegemon, the US, at least in the foreseeable future. Therefore, China would continue to treat energy giant Russia with its ailing economy as a “junior partner” to fuel its economy, rather an ally to topple down American hegemonic structure. Actually, this would enable additional supplies to world energy markets with depressed energy prices that might slow the pace of American led “unconventional revolution” temporarily causing further fluctuations in the world energy markets. As a safety cushion to its economic stability, we can expect China to take further steps to diversify away from the USD and urge its trading partners to accept Renmibi instead. By determining Renmibi as a medium in its natural gas deal with Russia, China has taken a robust step in this direction as a direct assault to reserve currency status of the USD (lenta.ru).

Last, but not least, how will the US under Donald Trump react Sino-Russian intensified relations? After Trump’s election a new rapprochement could be observed between the US and Russia since the neorealist Trump administration is expected to target China as the number one threat against its own interests unlike the Obama administration that targeted Russia with its neoliberal interventionist approach. In fact, this resembles the strategic choice made by the US in 1971 when President Nixon opted to have warm relations with China in order to contaminate the USSR, main rival, that time. Now the tables have turned and in this geopolitical triangle China seems to be the main rival of US due to shifts in international system and Russia will have to reconsider its situation between the east and the west by taking into consideration of this new reality after Trump with whom Russia could have better relations.

Annexes

Map 1: China’s Import Transit Routes/Critical Chokepoints

Map 2: Major Russian Oil Basins

Map 3: ESPO Pipeline Route

Map 4: ESPO Pipeline Route

Notes

References

Atlı, Altay (2013). “Değişen Çin ve Kriz Sonrası Dünya Düzenindeki Rolü” in Fikret Şenses, Ziya Öniş and Caner

Bakır (ed.), Küresel Kriz ve Yeni Ekonomik Düzen, İstanbul: İletişim Yayınları: 285-310.

Bagdonas, Azuolas (2012). “Russia’s Interests in the Syrian Conflict: Power, Prestige, and Profit”, European Journal of Economic and Political Studies, 5(2): 55-77.

Balzer, Harley (2005). “The Putin thesis and Russian energy policy”, Post-Soviet Affairs, 21(3): 210-225.

Beeson, Mark and Li, Fujian (2015). “What consensus? Geopolitics and policy paradigms in China and the United States”, International Affairs , 91(1): 93-109.

Bender, Jeremy and Rosen, Armin (2015). “This Pentagon map shows what’s really driving China’s military and diplomatic strategy”, Businessinsider , 13.05.2015, http://www.businessinsider.com/this-map-shows-chinas-global-energy-ties-2015-5#ixzz3fIkHnfLl ( accessed 12.04.2016).

Bijian, Zheng (September-October 2005)“ ‘China’s peaceful rise’ to great-power status”, Foreign Affairs , 84(5):18-24.

Birnbaum, Michael (2014). “Falling oil prices hit Russia much harder than Western sanctions”, The Washington

Post, (02.12.2014), http://www.washingtonpost.com/world/europe/falling-oil-prices-hit-russia-much-harder-than-western-sanctions/2014/12/02/91a5a5c4-79b3-11e4-8241-8cc0a3670239_story.html , ( accessed 05.03.2016).

BP (February 2015). Energy Outlook to 2035, http://www.bp.com/content/dam/bp/pdf/energy-economics/energy-outlook-2015/bp-energy-outlook-2035-booklet.pdf (12.04.2016)

Brewster, David (2016). “Silk Roads and Strings of Pearls: The Strategic Geography of China’s New Pathways in the Indian Ocean”, Geopolitics, DOI: 10.1080/14650045.2016.1223631

Camerona, David R. and Orenstein, Mitchell A.(2012). “Post-Soviet Authoritarianism: The Influence of Russia in Its ‘Near Abroad”, Post-Soviet Affairs, 28(1):1-44.

Carlsson, Marta, et.al.( June 2015). China and Russia – A Study on Cooperation, Competition and Distrust, Stockholm: FOI.

Charap, Samuel and Darden, Keith (2014) “Russia and Ukraine”, Survival, 56(2):7-14.

Cheney, Stephen A. (2014). “The American Solution to Europe’s Energy Woes”, The Wall Street Journal (28.10.2014), http://www.wsj.com/articles/the-american-solution-to-europes-energy-woes-1414526345 (accessed 12.04.2016).

Connolly, Richard (2011). “Financial constraints on the modernization of the Russian economy”, Eurasian geography and economics, 52(3): 428-459.

Desai, Radhika (2013). Geopolitical Economy: After US Hegemony, Globalization and Empire, London: Pluto Press.

Desai, Radhika (ed.) (2016). Analytical Gains of Geopolitical Economy, Emerald Group Publishing.

Economist (2014). “Why the oil price is falling”, (08.12.2014) http://www.economist.com/blogs/economist-explains/2014/12/economist-explains-4 (02.03.2015).

EIA (2014). “Russia looks beyond West Siberia for future oil and natural gas growth”, EIA, 19.09.2014, http://www.eia.gov/todayinenergy/detail.cfm?id=18051 (08.05.2016).

EIA , http://www.eia.gov/beta/international/analysis.cfm?iso=CHN

EIA, http://www.eia.gov/countries/cab.cfm?fips=rs (07.03.2016).

ERIRAS (2013). Global and Russian Energy Outlook up to 2040, http://www.eriras.ru/files/Global_and_Russian_energy_outlook_up_to_2040.pdf (accessed 02.07.2016).

European Commission, European Energy Security Strategy , Brussels, 28.5.2014

Foulon, Michiel (2015). “Neoclassical Realism: Challengers and Bridging Identities”, International Studies Review, 17(1): 635-661.

Fouskas, Vassilis K. and Gökay, Bülent (2012). The Fall of the US Empire: Global Fault-Lines and the Shifting Imperial Order, London: Pluto Press.

Frank, Andre Gunder (1998). ReOrient: Global Economy in the Asian Age, Berkeley: University of California.

Friedman, Thomas L.(2006). The world is flat: A brief history of the twenty-first century, New York: Farrar, Straus and Giroux.

Gaddyi Clifford G. and Barry W. Ickes (2014). “Can Sanctions Stop Putin?”, (03.06.2014), Brookings, http://www.brookings.edu/research/articles/2014/06/03-can-sanctions-stop-putin-gaddy-ickes (12.04.2016).

Gilpin, Robert (1981). War and Change in World Politics, New York: Cambridge University Press.

Gilpin, Robert (2001). Global Political Economy: Understanding the International Economic Order, Princeton, Princeton University Press.

Grygiel, Jakub J.(2006). Great Powers and Geopolitical, Baltimore: The John Hopkins University Press.

Gvosdev, Nikolas K. and Marsch, Christopher (2013). Russian Foreign Policy: Interests, Vectors, and Sectors, Los Angles: CQ Press.

Haverluk, Terrence W., et.al.(2014). “The Three Critical Flaws of Critical Geopolitics: Towards a Neo-Classical Geopolitics”, Geopolitics, 19(1): 19-39.

Hedlund, Stefan, “China benefits as West’s sanctions drive Russia eastwards”, World Review , 19.05.2015, http://www.worldreview.info/content/china-benefits-wests-sanctions-drive-russia-eastwards#60 (06.05.2016).

Henning, Bruce; Sloan, Michael; Leon, Maria De (October 2013), Natural Gas and Energy Price Volatility, Washington: American Gas Foundation, http://www.gasfoundation.org/researchstudies/volstudych5.pdf (04.02.2016).

Herpen, Vancel H.(2004). Putin’s Wars: The Rise of Russia’s New Imperialism, Maryland:Rowman&Littlefield.

Hill, Fiona and Gaddy Clifford (2003). The Siberian curse: How communist planners left Russia out in the cold, Washington: Brookings Institution Press.

Hoge, James F. (July/August,2004). “A Global Power Shift in the Making”, Foreign Affairs, 83(4):2-7.

Huntington, Samuel (1997). The Clash of Civilizations and the Remaking of World Order, New York: Touchstone.

IEA (November 2012). World Energy Outlook, Paris: International Energy Agency.

Independent (2005). “Putin: Collapse of the Soviet Union was ‘catastrophe of the century’”, (26.04.2005) http://www.independent.co.uk/news/world/europe/putin-collapse-of-the-soviet-union-was-catastrophe-of-the-century-6147493.html (accessed 02.05.2016).

Jisi, Wang and Lieberthal, Kenneth G. (March 2012). Addressing U.S.-China Strategic Distrust, Washington: The John L. Thornton.

Kagan, Robert (2012). The Revenge of Geography: What the Map Tells Us About Coming Conflicts and the Battle Against Fate, New York, Random House.

Karaganov, Sergey (2012). “Russia Needs One More Capital in Siberia”, Global Affairs, 21.06.2012, http://eng.globalaffairs.ru/pubcol/Russia-Needs-One-More-Capital–in-Siberia-15567 (28.04.2016).

Kelly, Phil (2006). “A critique of critical geopolitics”, Geopolitics, 11(1):24-53.

Kennedy, Paul (1989). The Rise and Fall of the Great Powers, New York, Vintage.

Khrushcheva, Olga, “The Controversy of Putin’s Energy Policy: The Problem of Foreign Investment and Long-Term Development of Russia’s Energy Sector”, CEJISS, 1:164-188.

Kireeva, Anna (Winter 2012) “Russia’s East Asia Policy: New Opportunities and Challenges”, Perceptions, 17(4): 49-78.

Kremlin (2008). The Foreign Policy Concept of the Russian Federation (2008) http://archive.kremlin.ru/eng/text/docs/2008/07/204750.shtml

Kuchins, Andrew C. and Zevelev, Igor (2012). “Russia’s Contested National Identity and Foreign Policy” in Nau, Henry R., and Ollapally, Deepa M. (ed.), Worldviews of Aspiring Powers: Domestic Foreign Policy Debates in China, India, Iran,Japan, and Russia, Oxford, OUP:181-210.

Lake, David A.(2009). Hierarchy in International Relations, New York: Cornell University Press.

Larson, Welch Deborah and Shevchenko, Alexei (2014). “Russia says no: Power, status, and emotions in foreign Policy”, Communist and post-communist Studies, 47(3): 269-279.

Legvold, Robert (October-December 2006). “US-Russian Relations: An American Perspective”, Russia in Global Affairs, 4: 157-169.

Leichtova, Magda (2014). Misunderstanding Russia : Russian Foreign Policy and the West, Surrey:Ashgate.

Mahbubani, Kishore (2009). The New Asian Hemisphere:The Irresistible shift of Global Power to the East, New York: Public Affairs.

Mankoff, Jeff (2007). “Russia and the West: Taking the Longer View”, The Washington Quarterly, 30(2): 123-135.

Mankoff, Jeffrey (2012). Russian foreign policy: The return of great power politics, Maryland: Rowman & Littlefield.

Maugeri, Leonardo (June 2012). Oil: The Next Revolution , Cambridge: John F.Kennedy School of Government, Harvard University.

Mearsheimer, John J.(Sep./Oct 2014). “Why the Ukraine Crisis Is the West’s Fault”, Foreign Affairs, 93(5):77-89.

Mills, Robin (2015). “Winners and losers from Iran’s eventual return to global energy markets”, The Nation, (19.07.2015) http://www.thenational.ae/business/energy/winners-and-losers-from-irans-eventual-return-to-global-energy-markets (07.03.2016).

Minghao, Zhao (2015) “ ‘March Westwards’ and a New Look on China’s Grand Strategy”, Mediterranean Quarterly, 26(1): 97-116.

Ministry of Energy of the Russian Federation (2010). Energy Strategy for Russia: For the period up to 2030, (http://www.energystrategy.ru/projects/docs/ES-2030_(Eng).pdf (18.08.2015).

Morozova, Natalia (2009). “Geopolitics, Eurasianism and Russian foreign policy under Putin”, Geopolitics, 14(4): 667-686.

Navarro, Peter (2014) “China’s Real Goal: A Monroe Doctrine in Asia?”, 02.09.2014 , http://nationalinterest.org/blog/the-buzz/chinas-real-goal-monroe-doctrine-asia-11179 ( accessed 08.07.2016).

Newell, Richard G. and Iller, Stuart (2013). “The Global Energy Outlook”in Jan H.Kalicki and David L.Goldwyn (ed.), Energy & Security: Strategies for a World in transition, Washington, D.C.: Woodrow Wilson Center Press, Second Edition: 25-68.

Novatek Gas Company, http://www.novatek.ru/en/business/yamal/southtambey/ (accessed 17.08.2015)

Özdemir, Volkan (2014). “Oil Prices: Expectations vs. Price Setters”, (10.12.2014) http://www.eppen.org/en/index.php?sayfa=Yorumlar&link=&makale=157 (03.03.2015).

Panin, Alexander (2014). “China Gets Upper Hand in Gas Deals Amid Russia-West Tensions”, The Moscow Times, (10.11.2014) , http://www.themoscowtimes.com/business/article/china-gets-upper-hand-in-gas-deals-amid-russia-west-tensions/510910.html (accessed 12.04.2016).

Petroneft (2015) , “Wester Siberian Oil Basin”, http://petroneft.com/operations/west-siberian-oil-basin/ ( accessed 07.04.2016).

Poussenkova, N.(2009) “Russia’s future customers: Asia and beyond”, J.Perovic, R.W. Orttung, and A. Wenger (ed.) Russian Energy Power and Foreign Relations: Implications for Conflict and Cooperation, New York: Routledge: 132-154.

Rangsimaporn, Paradorn (2009). Russia as an aspiring great power in East Asia, Oxford : Palgrave Macmillan.

Rose, Gideon (1998). “Neoclassical Realism and Theories of Foreign Policy”, World Politics, 51(1): 144–77.

Rourke, Ronald O’. (2016), “China Naval Modernization: Implications for U.S. Navy Capabilities- Background and Issues for Congress” , Congressional Research Service, https://fas.org/sgp/crs/row/RL33153.pdf ( 12.01.2017).

Rousseau, Richard (2012). “Will China Colonize and Incorporate Siberia ?”, Harvard International Review, (09.07.2012) http://hir.harvard.edu/will-china-colonize-and-incorporate-siberia ( accessed 22.04.2014).

Rousseau, Richard (2013). “The Kremlin’s Strategic Plans for Siberia”, The Washington Review, January 2013, http://www.thewashingtonreview.org/pdf/articles/the-kremlins-strategic-plans-for-siberia.pdf ( accessed 03.01.2016).

Rozman, Gilbert, et.al.(eds.) (1999). Russia and East Asia: The 21st Century Security Environment, New York, East West Institute.

RT (2016). “Russia-China military ties ‘at all-time high,’ no threat to other states”, 23.11.2016, https://www.rt.com/news/367880-russia-china-cooperation-stability/ (12.01.2017).

RT (2016).“ Impossible to belittle Russia’s role in Syrian settlement”, 07.04.2016, https://www.rt.com/news/338822-russian-role-syria-putin/ (12.04.2016).

Rühl, Christof (2014). “ The five global implications of shale oil and gas”, Energypost (10.01.2014) , http://www.energypost.eu/five-global-implications-shale-revolution/ (accessed 05.02.2016).

Secrieru, Stanislav (2006). “Russia’s Foreign Policy under Putin: ‘CIS Project’ Renewed”, UNISCI Discussion Papers , 10: 289-308.

The Ministry of Foreign Affairs of the Russian Federation (2013). Concept of the Foreign Policy of the Russian Federation, http://www.mid.ru/brp_4.nsf/0/76389FEC168189ED44257B2E0039B16D (accessed 09.03.2016).

Trenin, Dimitri (2009) “Russia’s Spheres of Interest, not Influence”, The Washington Quarterly, 32(4): 3-22.

Trenin, Dmitri (2014). The Ukraine Crisis and the resumption of great-power rivalry, Moscow: Carnegie Moscow Center.

Tsygankov, A.P.(2009). “Eastern Promises”, Russia Now. (18.12.2009) http://www.washingtonpost.com/wp-adv/advertisers/russia/articles/opinion/20091218/eastern_promises.html (accessed 28.07.2016).

Tsygankova, Andrei P. (2005). “Vladimir Putin’s vision of Russia as a normal great power”, Post-Soviet Affairs, 21(2): 132-158.

Victor, David.G.(2013). “The Gas Promise”, in Jan H.Kalicki and David L.Goldwyn (ed.), Energy & Security: Strategies for a World in transition, Washington, D.C.: Woodrow Wilson Center Press, Second Edition: 88-106.

Vyacheslav Y. Belokrenitsky and Alexei D. Voskressenski (2004) “Vneshnaya Politika Rossii Na Aziatskom Napravlenii”(The Asian Dimension of Russia’s Foreign Policy), in Anatoly V. Torkunov (ed.), Sovremennye Mejdunarodnye Otnosheniya i Mirovaya Politika (Contemporary International Relations and World Politics), Moscow , MGIMO.

Washington Post (2004) “Transcript: Putin says Russia will protect the rights of Russians abroad”, (18.03.2014), http://www.washingtonpost.com/world/transcript-putin-says-russia-will-protect-the-rights-of-russians-abroad/2014/03/18/432a1e60-ae99-11e3-a49e-76adc9210f19_story.html (01.07.2015).

Wendt, Alexander (1999). Social theory of international politics, Cambridge: Cambridge University Press.

Williams, Kristen, Steven Lobell, Neal Jesse (ed.) (2012). Beyond Great Powers and Hegemons: Why Secondary States Support, Follow or Challenge,Stanford: Stanford University Press.

World Energy Council (2015). Energy price volatility: the new normal, 2015 World Energy Issues Monitor, (Paris, 2015) https://www.worldenergy.org/wp-content/uploads/2015/01/2015-World-Energy-Issues-Monitor.pdf (12.04.2016).

Xuetong, Yan (2010). “The instability of China–US Relations”, The Chinese Journal of International Politics, 3(3): 263-292.

Yanık, Lerna K.(2013). “Krizden Krize Rusya’da İktisadi Değişim ve Dönüşüm” in Fikret Şenses, Ziya Öniş and Caner Bakır (ed.), Küresel Kriz ve Yeni Ekonomik Düzen, İstanbul: İletişim Yayınları: 219-240.

Yergin, Daniel (2014). “The Global Impact of Shale Gas” (08.01.2014) http://www.project-syndicate.org/commentary/daniel-yergin-traces-the-effects-of-america-s-shale-energy-revolution-on-the-balance-of-global-economic-and-political-power (07.03.2015).

«Газпром» и CNPC исключили доллар из расчетов за газ, Lenta, 16.06.2015, http://m.lenta.ru/news/2015/06/16/gazpromcnpc/