A New Phase in China-Latin America Economic Relations?

Chinese, Latin American, and other observers of the China-Latin America relations largely agree that the relationship is entering a new phase. Although much remains the same, there is evidence of remarkable divergence from China’s model of engagement with the region over the past two decades.

Continuity in the China-Latin America dynamic is most evident in macroeconomic analysis of the relationship.

Recent reports confirm that China-Latin America trade still primarily consists of South American primary commodities exports and imports of increasingly high-tech Chinese goods, from electricity transmission equipment to Lenovo computers. Global commodities prices have declined considerably in recent years, negatively impacting many of the region’s major exporters. But Chinese demand for the region’s commodities remains high, and is expected to continue at high levels in the near-term.

The makeup of Chinese foreign direct investment (FDI) in Latin America has also changed relatively little in recent years. Although FDI figures have grown somewhat, companies continue to invest in very specific sectors—extractives, agriculture, and infrastructure. And mergers and acquisitions of foreign firms continue to be seen as an effective way to develop a presence across entire supply chains.

Although the macroeconomic story has changed very little of late, recent developments in Latin America and China are altering Chinese engagement with the region in notable ways.

China’s approach to Latin America has already evolved somewhat as a result of the region’s changing political landscape, for example.

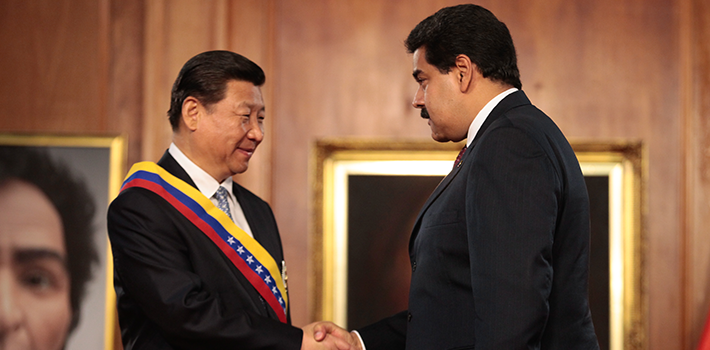

For many years, Chinese deal-making, especially in countries such as Venezuela, Ecuador, Argentina, and Brazil, has been facilitated by strong government-to-government and even personal relationships. But new political conditions in these countries are forcing a change in strategy on the part of Chinese banks and firms.

This is especially evident in the case of Argentina. China’s relative carte blanche in Cristina Kirchner’s Argentina has been replaced with a still friendly, but more cautious approach by Mauricio Macri. The Argentine president promised to review the various deals approved by his predecessor in pursuit of an increasingly “mature” relationship with China.

Time is of the essence if China is to seize on new investment opportunities in a changing Argentina, but traditional means of engagement (e.g., state-to-state negotiations of Chinese finance-backed public works projects) are of far less interest to Macri than they were to Kirchner. Instead, quality projects with long-term social and economic gains are of growing value in Argentina and throughout the region.

A two-day meeting between China and Latin American and Caribbean countries held at the Great Hall of the People in Beijing, China, Thursday, Jan. 8, 2015. (AP Photo/Ng Han Guan)

Some Chinese companies are already offering high-quality projects with provisions for local training and technology transfer. Others are adapting to the country’s increasingly competitive investment environment. Chinese companies, in partnership with foreign firms, were connected to three quarters of the solar projects that won Argentina’s 2016 Round One renewable energy tender. Still others will struggle make much progress in the region’s changing investment environment.

In an effort to both mitigate investment risk and to improve their image in the region, the Chinese government and individual companies are also working to diversify economic engagement.

In 2014, Beijing released its 1+3+6 and 3×3 policies to increase investment, trade, and finance in a wider variety of countries and sectors. These policies target growth-promoting industries such as logistics, power generation, information technology, and manufacturing.

Although Chinese FDI and finance are still predominantly focused on extractives and transport and energy infrastructure, some companies are making progress in other sectors.

Logistics has been a prominent area of focus in Bolivia, for example. China’s State Grid is involved in a wide variety of power projects in Brazil. Telecommunications giants Huawei and ZTE continue to make strides throughout the region and a fiber-optics deal was negotiated between Fenghuo and Ecuador’s Telconet in 2016. Huawei very recently proposed partnership with Etesca to sell smartphones and install Wi-Fi hot spots throughout Cuba.

In addition, China’s commercial banks, such as ICBC and Bank of China, are not only playing a growing role in project finance, but are increasingly invested in the region’s financial services sectors.

Latin America will continue to be of interest to China not only as a source of commodities and a valuable export market, but also as the Chinese government works to make progress on its own, very challenging, reform agenda. As in the case of the Belt and Road Initiative (BRI) in Asia, recently proposed infrastructure projects in Latin America, such as the Peru-Brazil Railway, are intended to facilitate trade, address China’s excess steel and labor capacity, internationalize Chinese companies, and effectively employ China’s still abundant foreign reserves.

The challenge for Latin America nations, should Chinese entities continue to approach them with new and increasingly diverse proposals, will be to facilitate engagement while ensuring high-quality, competitive, and sustainable deal-making. This has been a challenge for many Latin American governments over the past two decades. It remains to be seen how the newest ones will manage.

This article is published under a Creative Commons Attribution-NonCommercial 4.0 International licence.